Innovative Health Plan Solutions

Get the coverage you want with high-quality care at an affordable rate.

The traditional healthcare model isn’t working anymore for companies and their employees, who are paying too much and getting too little.

Nationally, medical costs increase yearly because legacy carriers using traditional networks and contracts with providers and facilities fail to capture the savings available through direct contracting and cash pay. This is the most expensive way to pay for care 99% of the time.

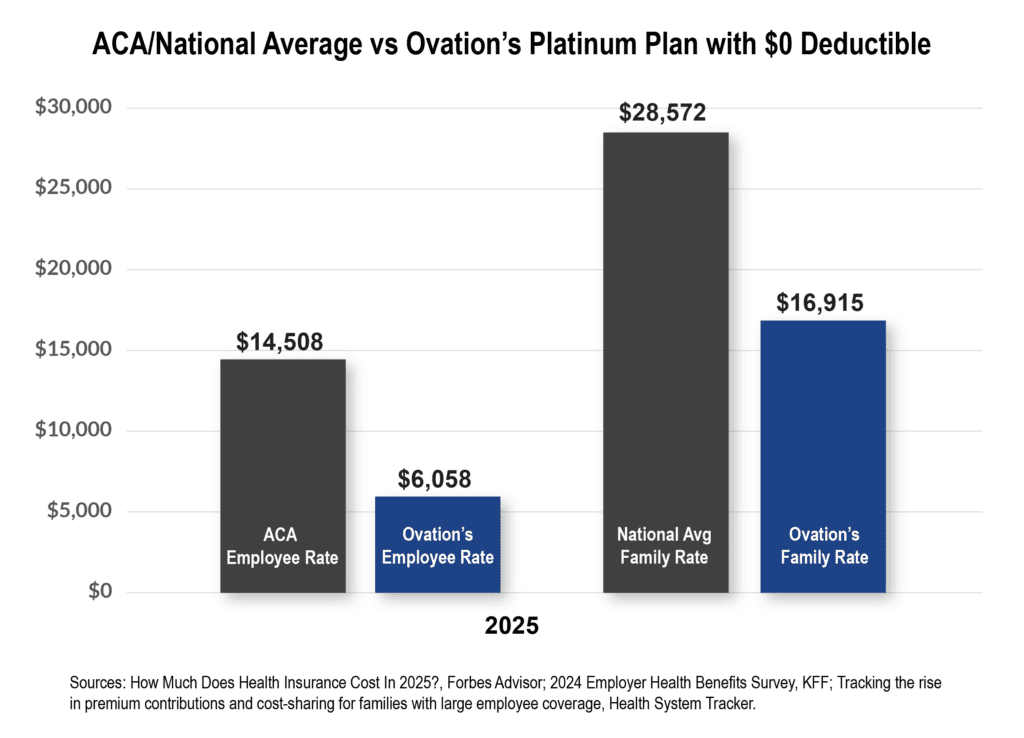

That’s why Ovation completely reimagined the healthcare experience with our comprehensive healthcare solutions. In fact, we have helped employers save up to 40% on their healthcare premiums.

We have a better way!

As a leading provider of premium primary care benefits offering fully level-funded, partially self-funded and fully self-funded programs, we can provide you with solutions that cost less and provide you with more flexibility, allowing you to tailor your health plan to the needs of your group.

► Our long-term clients have performed well within our health plans and have enjoyed an average premium increase of only 2.5% over the last six years.

► In 2024, we secured an overall reduction in billed charges of 85% and saved our clients $27 million.

Through concierge service and a hands-on approach to care coordination, we are able to achieve dramatic savings for our groups.

A different path to better benefits and lower costs

The good news is, rising healthcare costs have led to new alternative plan designs that aim to keep medical costs low, without sacrificing quality care.

Below are three of the most common alternative health insurance strategies that businesses are using to manage rising costs, compliance, and employee expectations.

► Self-Funded (Self-Insured) Plans – Best for businesses with 50+ employees with risk tolerance and stable cash flow.

• The Employer assumes the financial risk for providing healthcare benefits.

• Often paired with stop-loss insurance to limit catastrophic losses.

• Requires more administration but allows customized benefits and potential savings.

► Level-Funded Plans – Best for businesses with generally healthy employee populations.

• A hybrid between fully insured and self-funded.

• Employers pay a set monthly amount to cover claims, admin, and stop-loss insurance.

• If claims are lower than expected, the business may get a refund at year-end.

► Professional Employer Organizations (PEOs) – Best for businesses wanting to outsource HR and benefits to reduce complexity.

• SMBs join a co-employment relationship with a PEO.

• Gains access to large-group benefits, lower premiums, and HR support.

• PEO handles payroll, benefits, compliance, and more.

Whatever size your business is, we can help you reduce costs without sacrificing quality care. We are a licensed TPA with fixed rates for services that have not increased in the past 8 years, and we are confident that we can help you transition to a self-funded or level-funded health plan that meets your budget without compromising care for your employees.

Better plans by design.

Through personalized care coordination, negotiation of medical and drug costs, and quarterly plan performance reviews we can ensure the stability of premiums and shared costs.

Our health plans have many advantages over traditional health plans.

► Employers can save on premium costs as they are only paying for the needs of their employee group.

► Employers can tailor their plan to best meet the unique needs of their employee group.

► Through our employer quarterly performance review reports we can provide guidance and recommend changes for better cost containment.

If you’re frustrated with the rising costs of health care and having a hard time finding affordable quality benefits for your employees, then reach out for a quote. Let’s work together to design a better health plan for you and your employees.

Learn more about your ACA Compliance responsibility

If you are a business with 50 or more full-time equivalent (FTE) employees, then you are subject to specific ACA requirements, including:

- Offering affordable, minimum essential coverage (MEC) that provides minimum value to at least 95% of their full-time employees and their dependents.

- Fulfilling annual reporting requirements by filing Forms 1094-C and 1095-C with the IRS and providing statements to employees detailing health coverage offers.

- Complying with specific ACA provisions to avoid potential penalties for non-compliance.

Click on the link below for an overview of ACA Compliance.